Medical Deductions For 2024. How to claim eligible medical expenses on your tax return. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi).

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). Tax deductions for medical expenses can provide.

For More Information, Please See Medical Scheme Fees Tax Credits.

Are medical expenses tax deductible?

The Limit For Tax Deductions In 2024 Is 7.5% Off Adjusted Gross Income And It Is Very Crucial To Examine All The Medical Expenditures And Evaluate Them Accurately.

Updated on january 8, 2024.

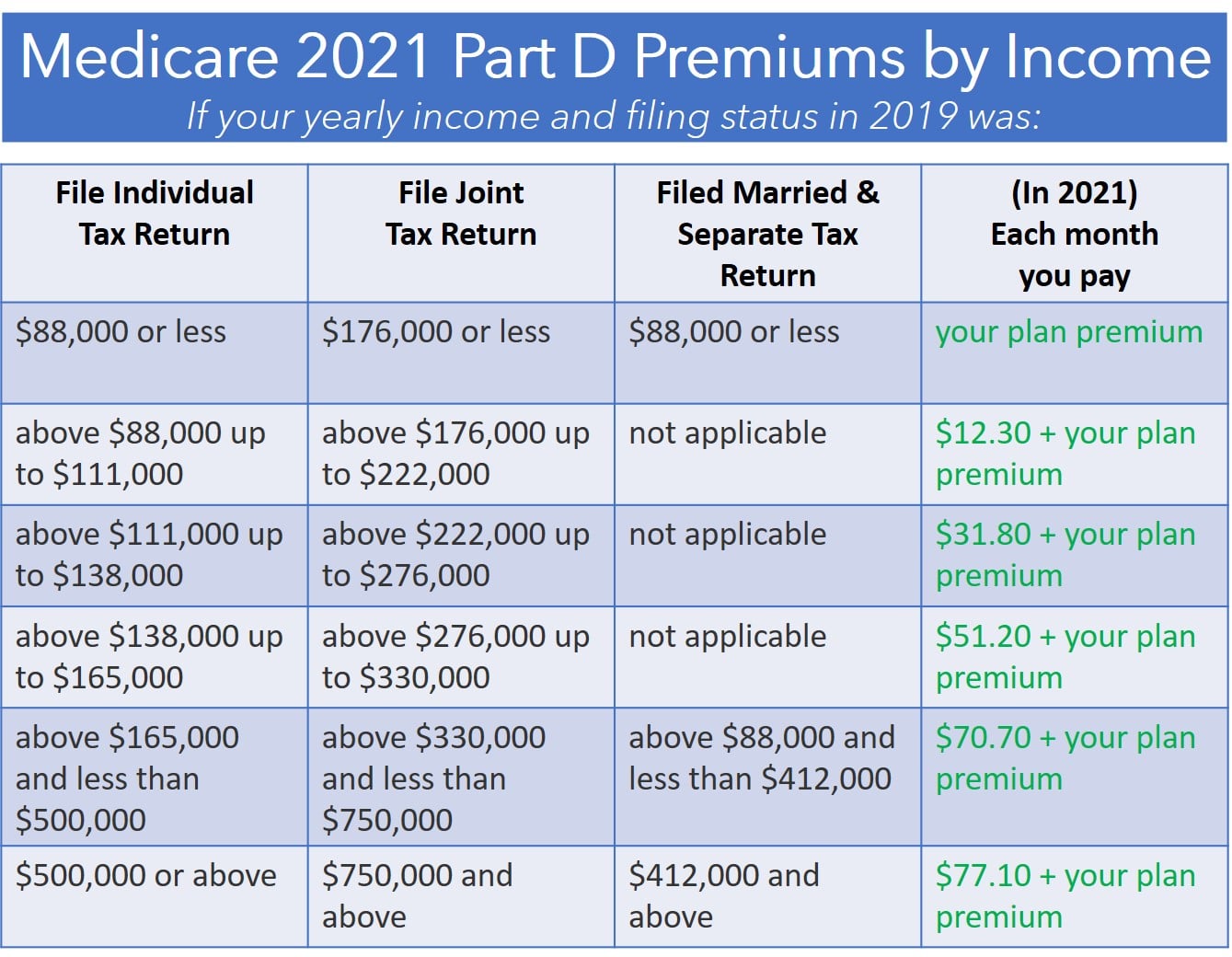

Here's How Those Break Out By Filing Status:

Images References :

Source: www.marca.com

Source: www.marca.com

Medical expenses deduction How much can you actually deduct? Marca, Medical expenses you can claim. If you’ve incurred substantial medical or dental costs in 2024, you may be eligible to claim deductions that can help lower your taxable income and potentially lead.

Source: www.techcrums.com

Source: www.techcrums.com

Medical Deductions What’s Covered and How Much is Deducted Techcrums, You can claim the total eligible medical expenses minus either 3% of your net income or $2,479, as specified by the cra, whichever is less. Tax deductions for medical expenses can provide.

Source: www.nsktglobal.com

Source: www.nsktglobal.com

Guide To Medical Expense Deductions for Tax Season 2024 NSKT Global, If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct the medical and dental expenses you paid for yourself, your spouse, and your dependents during the taxable year to the extent. Common health & medical tax deductions for seniors in 2024.

Source: deidreqardelis.pages.dev

Source: deidreqardelis.pages.dev

Healthcare Marketplace Limits 2024 Danny Orelle, Under section 80d, if a person is a senior citizen (60 years or above), then the maximum deduction limit for the health insurance premiums paid is rs. Updated on january 5, 2024.

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Have Medicare Part B Payments Deducted From Social Security, Medical and dental expenses can add up quickly. Records need to substantiate a casualty.

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

Can I Deduct Medical Expenses? Ramsey, Health care and medical expense tax deductions for seniors. Medical expenses you can claim.

Source: www.youtube.com

Source: www.youtube.com

How to record medical deductions from a 3rd party check into QuickBooks, The guide gives information on eligible medical expenses you can claim on your tax return. For example, if you itemize, your agi is $100,000 and.

Source: atonce.com

Source: atonce.com

50 Secrets Maximizing Tax Deductions on Medical Expenses 2024, For the tax years 2023 and 2024, the threshold is 7.5% of your agi. Tax deductions for medical purposes should be liberalised, say experts.

Source: individuals.healthreformquotes.com

Source: individuals.healthreformquotes.com

MediCal Qualification & eligibility Magi no asset test, The 7.5% threshold used to be 10%,. Salaried taxpayers can opt between old and new tax regimes.

Source: www.aarp.org

Source: www.aarp.org

Congress Needs to Maintain Medical Expense Deductions, To accomplish this, your deductions must be from a list approved by the. This publication also explains how to treat.

Updated On January 5, 2024.

Claiming medical expense deductions on your tax return is one way to lower your tax bill.

Single Taxpayers 2024 Official Tax.

To accomplish this, your deductions must be from a list approved by the.